Introduction

When it comes to banking, keeping track of your account numbers, routing numbers and other financial information can be overwhelming. With so many different numbers in play, it's easy to confuse them with one another. In this article, we will explore the differences between routing numbers and account numbers. We'll discuss what they are used for, where you can find them on your checks or statements, and why it is important to understand the distinction between them.

What is a Routing Number?

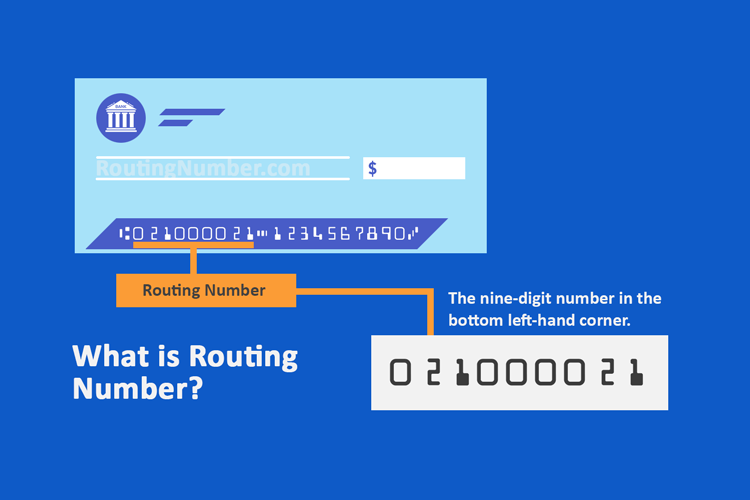

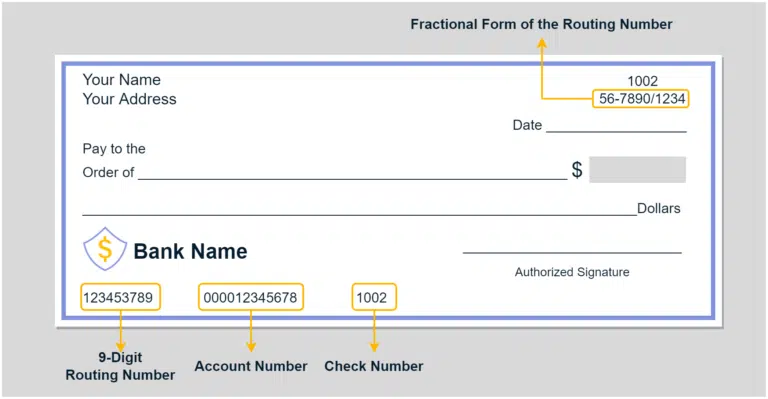

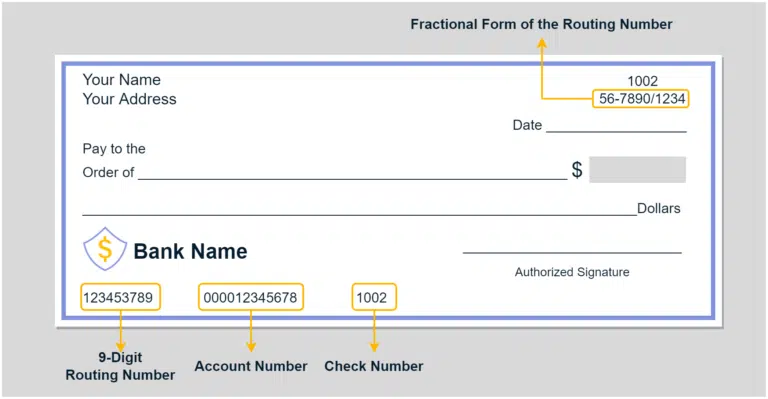

A routing number is a nine-digit code that identifies your bank and its location within the United States. It is typically found on the bottom left corner of personal checks or at the top of deposit slips. A routing number's purpose is to ensure that the funds are sent to and from the correct financial institution.

What Are Routing Numbers Used For?

Routing numbers are mainly used for wire transfers, direct deposits, or other automated payments such as bill pay or automatic transfers between accounts. The routing number can also be found at the bottom of your checkbook. Using the correct routing number when making a payment is important, as it ensures that funds are received at the correct financial institution.

What is an Account Number?

An account number is a unique string that identifies your bank account. It can be found on the bottom right corner of personal checks or at the top of deposit slips. An account number's purpose is to ensure that any deposits, withdrawals, and transfers are correctly credited to or deducted from your account.

What Are Account Numbers Used For?

Account numbers are typically used for outgoing transactions where money is sent from your account to another person. This could include sending money via online banking, mailing a check, or using a debit card. Using the correct account number when sending funds is important as it ensures that your payment is credited to the correct bank account.

Routing Numbers & Account Numbers

When managing our finances, we often come across various numbers and codes that need clarification to keep track of. Two such numbers are routing numbers and account numbers – both important in their own right but serving very different purposes. Routing and account numbers are two of the most important pieces of information associated with your bank account. A routing number is a nine-digit code that identifies your financial institution and allows banks to route funds between each other. An account number is used to identify the owner of an account. Usually, a checking or savings account is at a financial institution.

How Do Routing Numbers Differ From Account Numbers?

The main difference between routing numbers and account numbers is that routing numbers are used for incoming transfers, while account numbers are used for outgoing transfers. Routing numbers also inform where bank accounts are maintained, such as which branch or state they're in. On the other hand, account numbers are generally used to identify a specific bank account and the owner of that account.

Why Does it Matter?

Understanding the difference between routing and account numbers is important because they serve different purposes. A routing number is used to locate your bank, while an account number identifies which specific bank account you want funds sent to or debited from. If you enter the wrong routing number or account number when making a payment, transfer, deposit, or withdrawal, you may experience delays in processing your transactions.

Where Can I Find My Routing Number and Account Number?

The routing number is usually in the left corner, while the account number is typically in the right corner. If you cannot find these numbers on your checks or statements, contact your bank to get them accurately identified.

Conclusion

In conclusion, it's important to understand the difference between routing numbers vs. account numbers so that you can make sure any transactions or deposits go to the correct financial institution and account. Routing numbers are used to locate your bank, while an account number identifies which specific bank account funds should be sent to or debited from. Both can typically be found on the bottom of personal checks or at the top of deposit slips. Contact your bank for assistance if you have any questions about your routing number or account number. By understanding the differences between routing numbers and account numbers, you'll be better equipped to manage your banking needs more efficiently in the future.